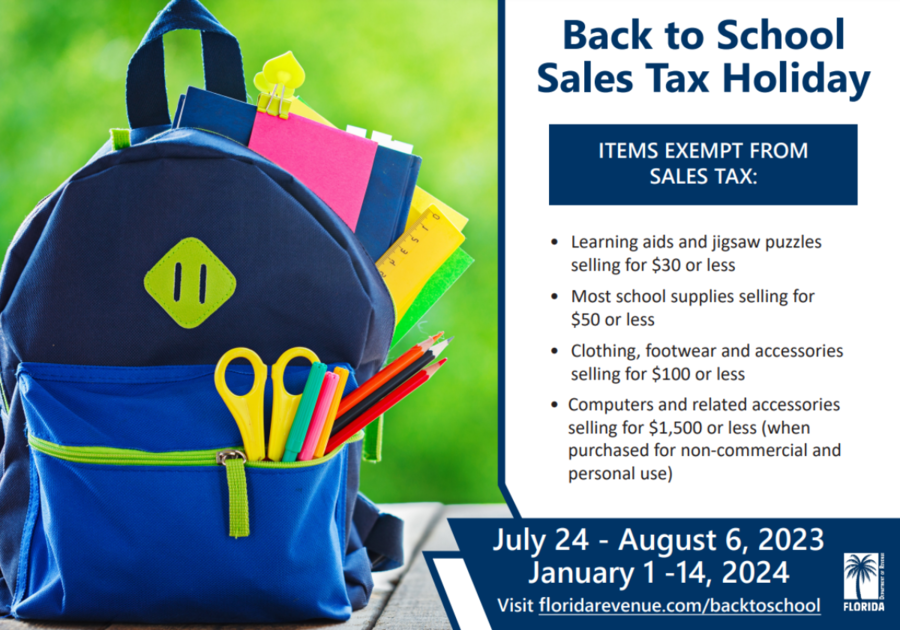

Back to School Tax Holiday

July 24, 2023 - August 6, 2023

January 1, 2024 - January 14, 2024

On May 6, 2022, Governor Ron DeSantis signed House Bill 7071 which provides $1.2 billion+ of tax relief for us Floridians. The bill lists ten sales tax holidays , including fuel, diapers, disaster supplies and, tools. This bill includes a 14-day Back-to-School sales tax holiday from July 24 through August 6, and January 1 through January 14.

Here is a breakdown of what is included in the Back to School tax holiday, per the Tax Information Publication.

Between 7/24/23 - 7/6/23 and 1/1/24 - 1/14/24, you won't be taxed on:

- Clothes, shoes, and certain accessories ($100 or less per item)

- Any article of wearing apparel, including all footwear intended to be worn on or about the human body

- Bike helmets that are labeled "for kids" are always tax exempt

- Religious clothing (clerical vestments, choir/altar clothing), prescription, prosthetic, and orthopedic item are always tax exempt

- Any article of wearing apparel, including all footwear intended to be worn on or about the human body

- Certain school supplies ($50 or less per item)

- Binders

- Calculators

- Cellophane (clear) tape

- Colored pencils

- Compasses

- Composition books

- Computer disks (blank CDs only)

- Construction paper

- Crayons

- Erasers

- Folders

- Glue (stick and liquid)

- Highlighters

- Legal pads

- Lunch boxes

- Markers

- Notebook filler paper & Notebooks

- Pencils (including mechanical and refills)

- Pens (including felt, ballpoint, fountain, highlighters and refills)

- Poster board & paper

- Protractors

- Rulers

- Scissors

- Staplers and staples (used to secure paper products)

- Learning/educational aids and puzzles ($30 or less)

- Electronic books

- Flashcards & Learning cards

- Interactive books

- Jigsaw puzzles & Puzzle books

- Matching & Memory games

- Search-and-find books

- Stacking or nesting blocks or sets

- Toys that teach reading or math skills

- Personal computers and certain computer-related accessories for noncommercial/personal use ($1,500 or less)

- Electronic book readers

- Laptops & desktop computers

- Handheld devices & tablets

- Tower computers

- Keyboards

- Mice (mouse devices)

- Personal digital assistants

- Monitors

- Modems & routers

- Nonrecreational software

Does not apply to:

- Clothes ($100+)

- Skis

- Swim fins

- Roller blades

- Skates

- Watches & watchbands

- Jewelry

- Umbrellas

- Handkerchiefs

- Anything purchased within a theme park/ entertainment complex/ public lodging establishment/ airport

- School supplies ($50+)

- Books not otherwise exempt

- Computer paper

- Correction tape, fluid or pens

- Masking tape

- Printer paper

- Books (except those that are exempt)

- Computers and computer-related accessories ($1,500+)

- Batteries (unless used for prosthetic or orthopedic appliances)

- Cases for electronic devices (including electronic reader covers)

- CDs and DVDs (music, voice, prerecorded items)

- Cellular telephones (including smart telephones)

- Computer bags & paper

- Computers designed and intended for recreation (games and toys)

- Copy machines and copier ink and toner

- Digital cameras & digital media receivers

- Fax machines (stand-alone)

- Furniture

- Game controllers (joysticks, nunchucks)

- Game systems and video game consoles

- Games and gaming software

- MP3 players or accessories

- Projectors

- Rented computers or computer-related accessories

- Surge protectors

- Tablet cases or covers

- Televisions (including digital media receivers)

- Commercial/Business Computers and computer-related accessories

- Personal computers or computer-related accessories for use in a trade or business, or to sales within a theme park, entertainment complex, public lodging establishment, or airport.

- Rentals of the eligible items

- Repairs or alterations of the eligible items

- Sales from theme parks, entertainment complexes, lodging establishments or airports

Fine Print:

- Items sold as a unit & sets - can't be sold individually to qualify for tax exemption

- Buy One Get One Free - the total price of items counts towards the exemption qualification; you cannot average the item prices

- Gift Cards - there are no taxes when you buy/sell a gift card; you can use a gift card to purchase eligible items tax free, as a payment method; this does not apply after the sales tax holiday ends

- Remote Sales - eligible items are still exempt if purchased during sales tax holiday window, regardless of when delivery is made

- Coupons/Discounts - the total price after the coupon/discount is used towards the total price, determining the tax exemption

- Rain Checks - if purchasing a previously rain-checked item during the tax holiday, the item qualifies for exemption; if you rain check during tax holiday, but purchase after it ends, the exemption no longer applies

- Layaways - the item put on layaway will qualify for the exemption if delivery of the item is made during the tax holiday or if an eligible item is put on layaway, but the final payment is made after the tax holiday ends

- Service Warranties - if the retail item was sold with the tax exemption, the warranty will be tax exempt as well

- Returns - if returning an item purchased during tax holiday, you must show documentation (i.e. a receipt) that tax was paid on the item during the holiday, if you want a refund of the tax as well

- Exchanges - if item is purchased during tax holiday, no tax will be due on the exchange of said item, even if after the tax holiday ends

- Shipping & Handling - if all items in the shipment were tax exempt, shipping charge is also exempt; if some of the items were not exempt, shipping will be calculated according to those non-exempt items

For full details about the exemptions and exceptions, check out the Tax Information Publication.

Here is the Florida Department of Revenue's Back to School Tax Holiday FAQs.

You can check out other Florida Tax Holidays and Exemptions, here!